Photo by CC user Kbrose on Wikimedia Commons

You must be sure that you are right in the midst of decision making process. You must decide when, what and how to trade. You also must go through the right learning and unlearning process. While many of us might be talking about how and when and what to trade, we should also know when not to trade and when to get out of the market.

Over the next few lines we will try and have a look at some time tested and proven theorems which could help you in making the right choices when you’re trading. This will help you to move away from a state of mind which often is referred to as “analysis paralysis”.

It Is All About Experience

If you believe that you can become an expert in trading overnight then you are in for some rude shocks. Trading in commodities, indices, and currencies is a learning process and therefore experience is the biggest teacher. Therefore you must believe in learning the tricks of the trade step by step and gather as much experience as you possibly can before heading over to CMC Markets. It would not be a bad idea to keep a trading journal where you should note down each and every significant event as it happens daily. This certainly will help you to identify the areas where you are making mistakes. You will make mistakes for sure but experience is all about learning from the mistakes and not repeating it again.

Do Not Bite More Than You Can Chew

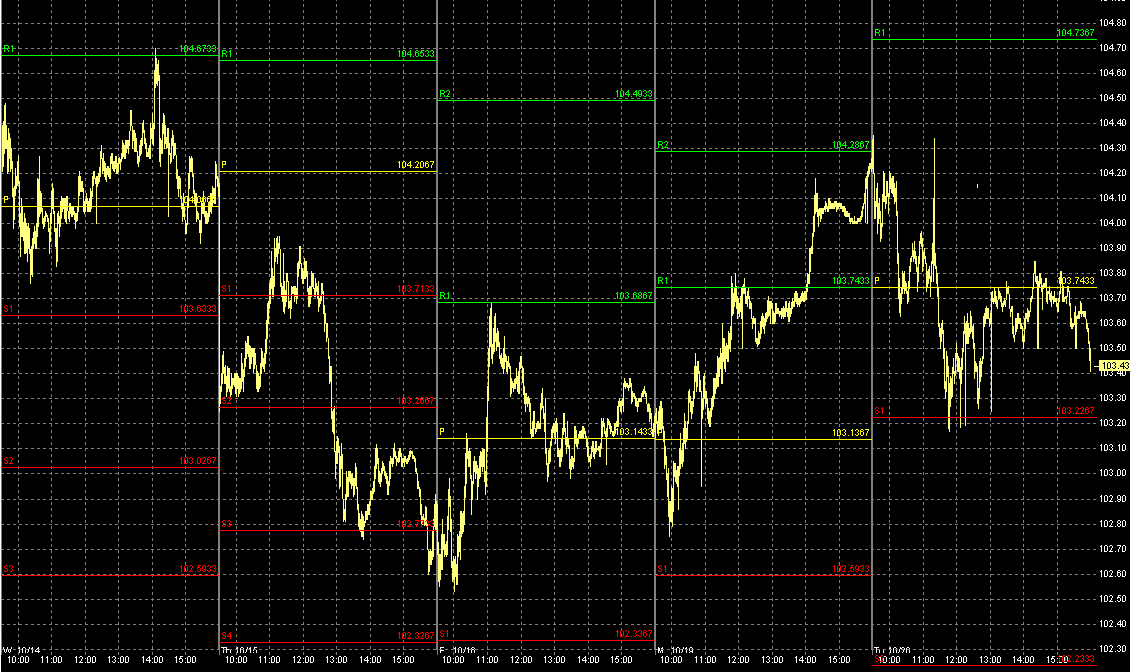

When you are in trading you certainly make use of various types of indicators. It is quite obvious that you could be cluttered with information and each one might interpret these indicators in their own way. You should find out ways and means by which you keep the number of indicators as low as possible. This is important because the more you clutter your decision making process, the more you are likely to make mistakes. Hence you must believe in keeping it simple and straight. This again will happen only with experience and therefore this point and the previous one are closely interlinked.

You Should How To Recover From Mistakes

There are hardly any traders who have not incurred losses and their success story is not all smooth sailing. You must therefore find out ways and means by which you can convert mistakes into learning grounds and learn to profit from it over a period of time. Many people often become paralyzed when they make losses and you should not be one of them if you wish to make it big. You must sit down and analyze the reasons for failure and take lessons from it rather than being stunned into inaction.

Intuition Has A Role To Play

Though many theoretical experts may have a different take on this, it has been proven time and again that your intuition can help you a lot in making the correct trading decision. If you make wrong use of it you could end up in a state of failure. Intuition is something that comes with experience. This is often referred to as expert intuition. You must also try and develop long term intuition. This is about intuition being driven by the brain which works in the background. This could be of strategic importance at times.

At times you might be at a loss to understand as to how your intuition made you take the decision. However, having said this it is important to understand that intuition does not work in thin air. It has to be backed by logic and figures and there should be some basis for it. There have been instances where intuition has enabled traders to take smart and fast decisions.

Importance Of Playing Learning Games

It is important to train the brain so that it is able to think correctly and think fast. You must therefore understand the importance of playing learning games. You will be playing in a demo environment and hence the risk of losing money can be ruled out. You could try and look for games which could help in speeding up the brain and its thinking capacity.